Today, she finds herself thrown into the political debate for her views on an economic recovery following a major financial disruption.

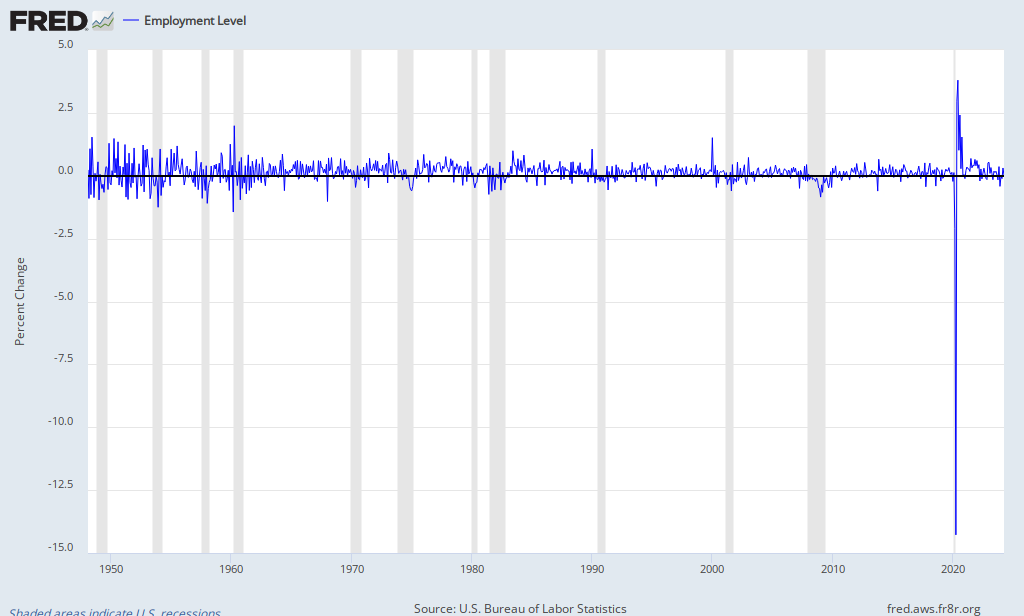

Rutgers University economic historian Michael Bordo and Cleveland Fed economist Joseph Haubrich studied just U.S. recessions going back to 1882 and found that U.S. recoveries following financial shocks tend to be rapid. Top economic advisers to Republican Mitt Romney have leaned on this research to argue that the culprit in the current slow recovery is Mr. Obama himself, not the financial crisis that preceded him. This line of research has taken issue with the Reinhart and Rogoff studies, arguing, among other things, that U.S. crises can’t be likened to financial crises that have happened elsewhere in the world — such as small developing markets – because their economic institutions are so different.When Barack Obama first took office he promised a quick recovery. We had just went through the largest financial disruption in over eighty years. Quick was not going to happen. Reinhart and Rogoff said so. In December of 2008 they posted, "The Aftermath of Financial Crises," in which they showed for major financial crises unemployment will remain above 7% for nearly five years. Why did Obama think this time would be different. It wouldn't be. Have we not learned anything?

Now Reinhart and Rogoff are firing back. In a short paper they released this weekend, they fire back at the Bordo work. They see several flaws. One of their main arguments is that the Bordo work includes borderline financial shocks which weren’t full blown crises. Reinhart and Rogoff argue that if the paper focused on the four full blown U.S. crises of the past 150 years – in 1873, 1893, 1907 and the 1930s – they would get results similar to the broad swath of international crises the Harvard professors examined.Four years ago, I was using Reinhart and Rogoff's view to criticize Obama's policy views. He made a mistake by telling the American people the recovery would be swift. Unfortunately, he was wrong. Should we be surprised? No, it did not matter what the president did in office or who we elected. After a financial crisis it takes a tremendous amount of time for capital markets to liquidate bad assets, home and stock prices to stabilize, and government debt to come under control.

Here we are, five years after the collapse of the housing market. What have we learned? Reinhart and Rogoff were correct once again.

Secondly, we assess how has the US has fared, so far, compared to other advanced economies countries that experienced systemic financial crises in 2007-2008 as well other advanced economies that experienced borderline episodes. Focusing on real per capita GDP, we show (i) the recent crises patterns confirm our earlier result that the countries that recently suffered systemic financial crises have generally fared quite poorly compared to countries where the financial problem was less severe, that is, borderline, and (ii) although tracking worse than the countries that did not have systemic financial crises, the United States output performance is, in fact, among the best of those that did.For more information, Rogoff did an interview here.

Ezra Klein has a nice write up here.